Inventory Balance comes from the Balance Sheet. Sales and Cost of Sales come from the Income Statement.

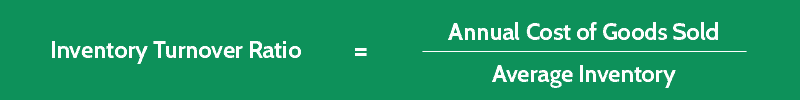

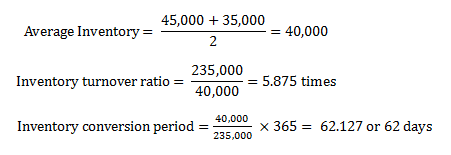

for the first quarter it would be the average of Jan, Feb, and Mar ending inventory)ĭays of Inventory = Ending Balance Inventory / Daily Cost of Goods Soldĭaily Cost of Goods Sold = Annual Cost of Goods Sold / 365Īppendix A – Calculating Days of Inventory and Inventory Turnover in ExcelĬells with a yellow background are input from your financial statements. Inventory Turnover = Annual Cost of Goods Sold / Average InventoryĪnnual Cost of Goods Sold = Average Monthly Cost of Goods Sold (base on 3 month moving average) times 12Īverage Inventory = the average of Last Month’s Inventory and This Month’s Inventoryįor Quarters, Year to Date Periods, Year Totals:Īnnual Cost of Goods Sold = Cost of Goods Sold for the time period divided by the number of months and times 12Īverage Inventory = the average of Each Month’s Ending Inventory balance within the time period (e.g. I propose these definitions for calculating Inventory Turnover and Days of Inventory in a reporting system that outputs separate values for months, quarters, year to date, and year totals. Days of Inventory on the other hand really is a measure of how much Inventory you have at an instant in time, so that Ending Inventory is more appropriate here. As such, it seems to me that Average Inventory is a better metric than Ending Inventory when calculating Turnover. I would argue that Inventory Turnover should measure your performance over some period of time, such as the current month, the first six months of the year (year to date), or the latest quarter. As part of your regular financial reporting, you’d like to calculate Inventory Turnover for the latest month, and also the year to date performance. However, you as a manager or business owner want to monitor your performance throughout the year. The publishers have a hard enough time getting reliable data once a year, much less on a more frequent basis. Most published statistics are based on year end data. It tells you how soon you will run out if you don’t re-order.ĭays of Inventory on hand is the inverse of Inventory Turnover when you are calculating it at year end. Instead of saying, “I turn my inventory over 12 times a year”, you would say “I’ve got 30 days worth on inventory on hand.” Some business owners are more comfortable thinking about days worth of inventory. Days of Sales just gives you another way to think of it. They both measure the same thing – one is just the inverse of the other. What is the difference between Inventory Turnover and Days of Sales in Inventory? If you are a member of a trade association, they might publish survey results that give you an idea of what the industry norm is.Īlso, if you are a member of a Profit Improvement Group (some are called 20 groups), this is the type of measure the group should be collecting and comparing each other against. For wholesalers of electrical goods it is 6.8. For Hardware stores, the national average is 3.5.

BizStats.Com publishes some national averages broken down by industry. What should your Inventory Turnover Ratio be? There are two ways to increase your Inventory Turnover Ratio: If you had $50,000 in inventory at the end of the year, your Inventory Turnover Ratio would be 450,000 divided by 50,000, or 9.0. So if you do $1 million per year in sales, and your cost of sales is 45%, that would mean your cost of sales is $450,000 per year. Inventory Turnover is calculated by taking your annual Cost of Goods Sold and dividing by the ending balance of your Inventory (at cost). That is where your judgment comes in, and why you get paid the big bucks. So rather than saying to yourself, “let me shoot for the highest possible Inventory Turnover Ration no matter what”, you really want to shoot for the highest possible Inventoy Turnover Ratio without losing sales or otherwise disrupting your operations. If you reduce your inventory dramatically, it could be that you lose sales because of stockouts. Like any other Key Performance Measure (KPI), you have to achieve a balance. A higher Inventory Turnover Ratio means that you have less cash tied up in inventory to support a given level of sales. In general, the higher your Inventory Turnover Ratio, the better.

So it makes sense for you to monitor this measure and do what you can to improve your performance. Turning that inventory over quickly is critical to your success. If you are a retailer or a wholesaler, your biggest investment is more than likely your inventory.

0 kommentar(er)

0 kommentar(er)